UNIQUE ZYX CHANGE METHOD

QUANTITATIVE ANALYSIS SCREEN

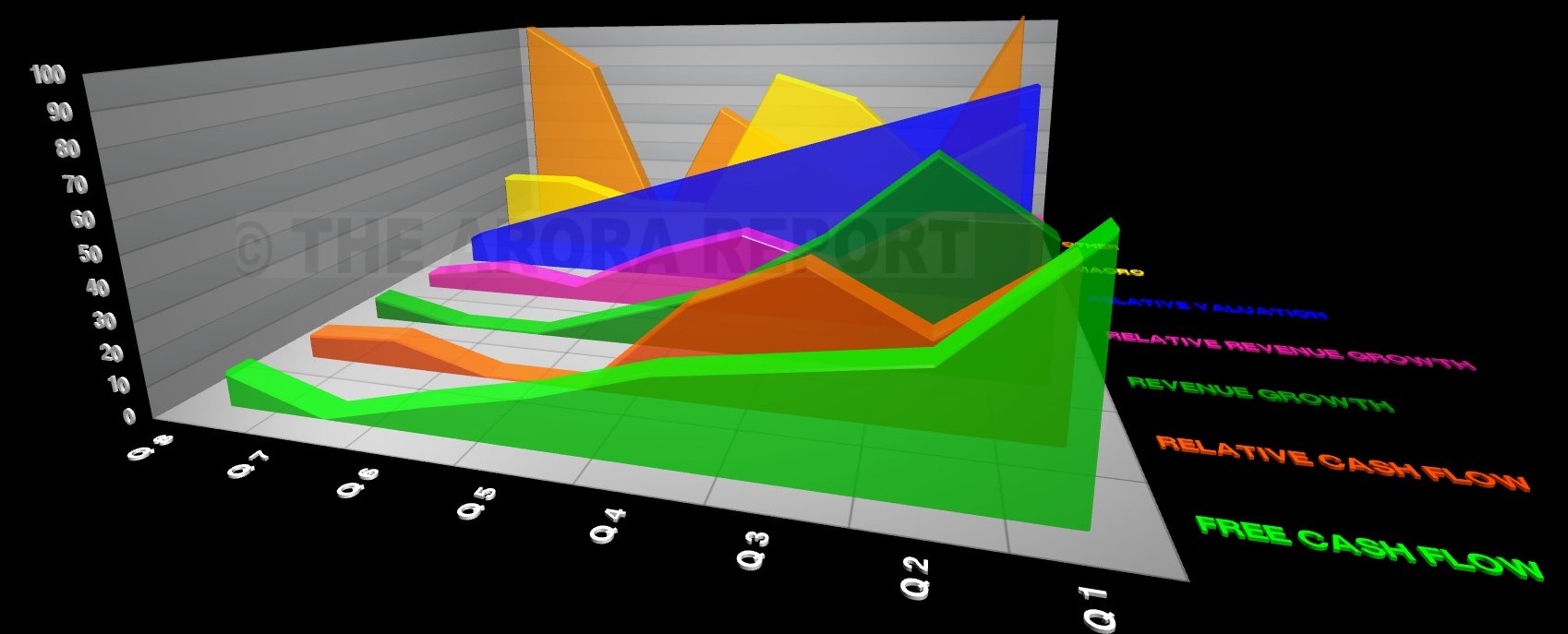

The quantitative screen of the ZYX Change Method has specialized variations for different types of positions. It is used only for medium-term, long-term and very long-term positions.

For individual stocks, it includes the following:

- Free cash flow trend over the last eight quarters

- Comparison of the present cash flow with the estimates of future cash flow

- Relative cash flow compared to the peers in the same industry

- Revenue growth trend over the last eight quarters

- Comparison of the present revenue growth with the future revenue growth

- Relative revenue growth compared to the peers in the same industry

- Valuation relative to its own history

- Valuation relative to the peers in the same industry

- Special factors

SIDE STEPPING TRADITIONAL QUANT CROWDED TRADES

The problem with traditional quants is that too many of them do the same trades at the same time. The result is crowded trades that are difficult to exit profitably. The ZYX Change Method successfully sidesteps this issue because the input of candidates to this screen is not quantitatively derived like traditional quantitative methods.